Leer en Español

With its high number of hurricanes and storms, Florida is historically one of the busiest states for catastrophic claims adjusting. Florida residents can follow our step-by-step guide below to get their Florida insurance claims adjuster license. We’ve also included information on how to renew your license and what reciprocity looks like for FL adjusters so you’ll have everything you need to obtain and maintain your license. This article covers, in detail, the five important steps below.

- Establish which Florida insurance license you need

- Meet the state’s requirements

- Obtain your license

- Apply for your license / appointment

- Stay compliant and maintain your license

Florida Adjuster License Types

Before we walk through the steps, let’s take a quick look at the different types of licenses in Florida. These are classified by number, so you want to make sure and move forward pursuing the right license.

- 6-20 Resident Adjuster: The license is for any resident of Florida looking to be a staff or independent adjuster.

- 7-20 Nonresident Adjuster: License for nonresidents of Florida who want to adjust claims there. This is the ideal license for those who are licensed in their home state and want reciprocal privileges in Florida. We do not recommend this license unless you hold your home state license because it will only allow you to work in Florida and offers no reciprocity.

- 70-20 Nonresident Designated Home State (DHS) Adjuster: If you live in a non-licensing state and want to declare a home state for licensing, this license is our top recommendation. But you should only get a nonresident DHS license if your home state doesn’t license adjusters. If your state licenses, you need to start there.

- 3-20 Public Adjuster: The 3-20 license is exclusively for public adjusters and requires a few more steps to get licensed. You can see complete instructions in our How to Get your Florida 3-20 Public Adjuster License blog article.

- 4-40 Customer Representative: There is one additional Florida insurance license offered by AdjusterPro and All-Lines Training, so we wanted to mention it to avoid any confusion. The 4-40 Customer Representative License is for Florida residents who work in insurance agencies or for insurance agents.

Step 1: Meet the Basic Requirements for the Florida Adjuster License

Before you start taking steps to get your license, make sure you meet Florida’s basic insurance adjuster license requirements.

Resident Adjusters

- Be at least 18 years of age.

- Be a resident of the state of Florida.

- Be a U.S. citizen or legal alien who possesses a work authorization for the Immigration and Naturalization Services.

Step 2: Obtain Your Florida Adjuster License Through an Approved Method

Florida has a few different paths to getting your adjuster license. By far, the quickest and easiest way to get your license is to take a state-approved designation course. This is how most Florida adjusters obtain their licenses and the path we recommend.

Options to get your Florida adjuster license:

1. Take a state-approved adjuster designation course, such as our Florida Certified Adjuster Designation. Students who complete our pre-licensing course and pass the included exam are exempt from taking the Florida state adjuster exam.

2. Take and pass the Florida Adjuster Examination through a testing provider

3. Meet one of the following criteria, which provides exemption from taking the Florida exam:

- Currently hold a license as a public adjuster in Florida

- Earned an insurance degree

- Including at least 18 semester hours of college credit in property, casualty, health, and commercial insurance from an accredited college or university.

- Official transcript is required.

- Currently hold a General Lines (Property and Casualty) Agent license.

- Obtain a Letter of Clearance verifying you held an all-lines adjuster license (company or independent) for at least one year immediately prior to applying for a Florida license.

- Must apply for a resident all-lines adjuster license within 90 days of becoming a Florida resident.

You can find additional details on the Department of Financial Services website.

Nonresident Adjusters

- Be at least 18 years of age.

- Not be a resident of Florida.

- Be a U.S. citizen or legal alien who possesses a work authorization for the Immigration and Naturalization Services.

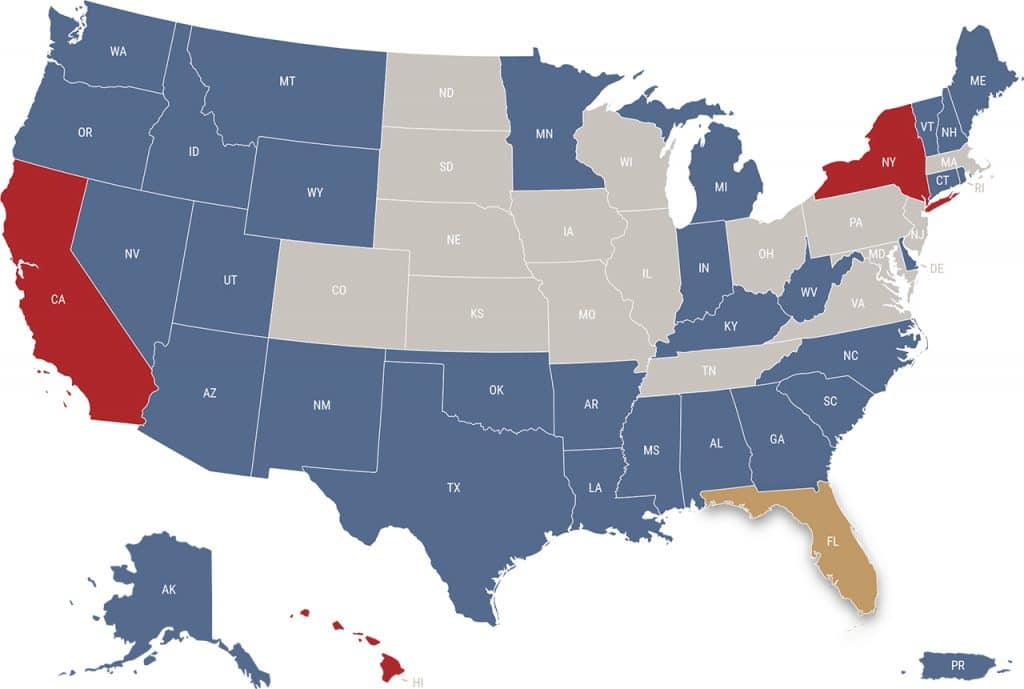

Insurance adjusters who hold a valid license in their home state may apply for a reciprocal license, as long as their home state has a reciprocal licensing agreement with Florida. To check if Florida offers your state reciprocal licensing privileges, visit our Reciprocity Map.

If you live in a state that doesn’t license insurance adjusters, we highly recommend obtaining the Florida 70-20 Designated Home State (DHS) License.

- To obtain the Florida 70-20 DHS License, you must complete one of the following:

- Take a state-approved adjuster designation course, such as our Florida Certified Adjuster Designation. Students who complete our pre-licensing course and pass the included exam are exempt from taking the Florida state adjuster exam.

- This is the same course resident adjusters take, however, you will apply for a different license type

- OR take and pass the Florida Adjuster Examination.

- Take a state-approved adjuster designation course, such as our Florida Certified Adjuster Designation. Students who complete our pre-licensing course and pass the included exam are exempt from taking the Florida state adjuster exam.

Step 3: Apply for your Florida Adjuster License

Once you have satisfied the requirements listed above, you’ll need to actually apply for your license, submit the appropriate paperwork, and pay your fees. As mentioned above, make sure you understand and are applying for the Florida license type that meets your needs. This will be designated by you on the application.

Florida requires all adjuster applicants to submit fingerprints for a background check. Process and submit your fingerprints according to instructions at Florida DFS Fingerprinting Requirements.

There are two methods for submitting fingerprints: LiveScan to submit electronically or Fingerprint Cards to submit by mail. Fingerprint results are processed much faster using the LiveScan method. Instructions for each method are at the bottom of this page.

Submit your adjuster application through MyProfile. Applicants concerned with criminal background questions can get more information on the FLCFO Criminal History page.

Submit your Proof of Citizenship Documentation with your application. You can check to see if your license has been issued by logging in to MyProfile.

Step 4: Florida License Appointment

In Florida, all insurance licenses require an appointment. Independent adjusters need to “self-appoint” by completing the following steps.

- Go to MyProfile and log in to your account.

- Select the “Access eAppoint” button under “Apply”. If you have never used eAppoint, you must first register and will need to select “Register to become an appointing entity.”

- Once in the eAppoint Workbench, select the required tab (New Appointment, Renew Appointment, or Terminate Appointment) and follow the instructions on the page.

- Pay the $60 fee.

Appointments must be renewed every 24 months during the appointee’s birth month.

Need help completing your application? Check out our Florida adjuster application instructional video below. We’ll walk you through the entire process, step by step.

Step 5: Maintain Your Florida Adjuster License

Once you have your Florida insurance claims adjuster license, you’ll need to complete some additional steps every few years to keep it active.

Florida requires 24 hours of continuing education (CE) every two years. The 24 hours must include the 4-Hour Law and Ethics update. The remaining 19 hours are electives. Florida Adjusters may not receive credit for any CE course taken twice in any 24-month period, regardless of their license compliance cycle. Be sure to track and plan your CE courses accordingly.

Florida independent adjusters will NOT receive credit for any approved course taken twice in two years. You cannot take the same course within a two-year period, regardless of the compliance cycle.

There is no license renewal required for Florida adjusters, provided the licensee is properly appointed when applicable. Failure to complete CE requirements may result in the cancellation of an appointment which could lead to termination of your license. The license will also expire if more than 48 months lapse without an appointment. You can log in to MyProfile to update your appointment. The reporting period for completing Florida CE is every two years by end of the licensee’s birth month.

AdjusterPro offers over 40 hours of state-approved continuing education courses for Florida insurance claims adjusters. Courses can be purchased individually or as a discounted bundle that will completely fulfill the 24-hour requirement.

View continuing education courses for Florida insurance adjusters.

How to Become an Insurance Adjuster in 5 Steps

Getting your home state or designated home state license is a great start. See what else it takes to establish a successful career in the insurance claims industry.

Additional Information for Florida Insurance Adjusters

Now that you know how to become an adjuster, let’s take a detailed look at the fees and costs of getting and maintaining your license.

Florida Adjuster Licensing Fees

- AdjusterPro Florida Certified Adjuster Designation +Exam: $299

- Initial Licensing & Application Fee: $50

- License ID Fee: $5

- Fingerprinting Fee: State: $50.75

- Independent Adjuster Appointment Fee: $60

- No Renewal Fee

Florida Adjuster License Reciprocity

Reciprocity means an adjuster holding a home state license can apply for an adjuster license in another state without having to take that state’s exam. If you want to learn more about reciprocity and why it’s vital to your success, visit our Reciprocity: The Truth About Adjuster Licensing Agreements Between States blog article.

Fees for reciprocal licenses vary by state, but on average you can expect to pay between $40 and $60 per application, although a few states charge up to $120. To see what states will offer reciprocal licensing privileges to Florida adjusters, visit our Florida Adjuster Reciprocity Map. At the bottom of the page, we also offer a downloadable guide to help you prioritize which reciprocal licenses you should get first.

Florida grants reciprocal licenses to adjusters who are licensed in a state that has a reciprocal agreement with Florida. CA, HI, and NY do not have reciprocal agreements with Florida. More information is also available at FLDFS Adjuster Reciprocity.

Florida Department of Financial Services Contact Information

Website: Florida Department of Financial Services

Mailing Address:

Florida Department of Financial Services

Bureau of Licensing, Room 419

200 East Gaines Street

Tallahassee, FL 32399-0319

Phone: 1-877-693-5236

Email: agentlicensing@myfloridacfo.com

Becoming a licensed Florida insurance adjuster is vital for those interested in working catastrophic claims in this era of volatile weather activity. Taking advantage of AdjusterPro’s ‘Certified Adjuster Designation’ ensures you can meet the state’s requirements while getting your Florida Adjuster License quickly and conveniently from your own home.

Whether you are ready to get your license or still have questions, we are here to help.