License Reciprocity.

Simplified.

Reciprocity means an adjuster holding a home state license can successfully apply for an equivalent license in another state without having

to take that state’s exam or pre-licensing course.

Reciprocity means an adjuster holding a home state license can successfully apply for an equivalent license in another state without having

to take that state’s exam or pre-licensing course.

Understanding reciprocity is vital if you want to make the most of your adjusting career. To put it plainly, the more licenses you hold, the better. Obtaining reciprocal licenses makes you more attractive to employers, increases your revenue, and allows you to help wherever you’re needed.

It’s important to note that reciprocal licenses are offered when you hold an equivalent license or a license with more lines of authority than what you are requesting.

If you live in a licensing state, you need to get your home state license first. Most states will only offer reciprocal licensing privileges to adjusters who hold their home or designated home state license.

Reciprocal licenses are offered when you hold an equivalent license or a license with more lines of authority than what you are requesting. For example, if you hold a P&C Adjuster License, you are only qualified for a P&C reciprocal license in another state. You can not obtain a reciprocal All-Lines license if your home state or DHS license is for P&C because it covers fewer lines of authority.

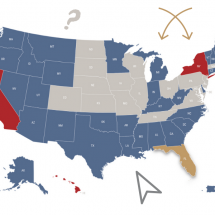

Select your licensing state below to see where you can get a reciprocal license.

Reciprocity, or reciprocal licensing privileges, allows a licensed adjuster to obtain another state(s) license without having to pass that specific state’s exam. Thank goodness, right? Once you have your home state or DHS license, you can apply for other state licenses through reciprocity.

It’s not automatic – you will need to complete the required paperwork and submit the licensing fees but most licensing states are now reciprocal with each other, as long as the license your home state or DHS license holds more lines of authority than what you are requesting. For example, if you hold a P&C Adjuster License, you are only qualified for a P&C reciprocal license in another state. You can not obtain a reciprocal All-Lines license if your home state or DHS license is for P&C because it covers fewer lines of authority.

There are some additional caveats – New York, California and Hawaii do not reciprocate with any other state for example. You can read more about the importance of reciprocity in our Reciprocity: The Truth About Licensing Agreements article.

It’s also important to note that reciprocity doesn’t always go both ways. For example, New York doesn’t offer reciprocal licenses to licensed adjusters from any other state. However, there are plenty of states that will offer licensed New York adjusters a reciprocal license.

To learn what states will offer you a reciprocal license, visit the AdjusterPro Reciprocity Map and click on your state.

The bottom line: the more licenses you have, the better. Whether it’s an insurance carrier or an independent adjusting firm, employers need adjusters who can work whenever and wherever claims happen. And you can only do that if you have the proper license for that state.

For example, employers may need to send hundreds of adjusters to Florida after a hurricane. The company checks their roster and adjusters who hold a Florida license are first in line for deployment. But the large number of adjusters sent to Florida leaves holes for the daily claims that will still need to be handled in states like Georgia and Mississippi. So now they need to find adjusters who are licensed in those states to come in and work. You get the idea….

Bottom Line: being licensed in multiple states will make you more attractive to employers, increase your revenue, and allow you to help wherever you are needed.

If you live in a non-licensing state, you should obtain a “Designated Home State” or DHS license. A DHS license basically works just like having your home state license and is vital if you want to work any claims outside of your non-licensing state. If you live in Kansas for example, you can adjust claims there without a license, but you can’t go work claims in Florida or Texas. While a host of different states offer a DHS license, we recommend obtaining the Florida 70-20 Nonresident DHS license. It offers great reciprocity and Florida has the quickest application turnaround time in the country.

States that do not currently license adjusters: Colorado, District of Columbia, Illinois, Iowa, Kansas, Maryland, Massachusetts, Missouri, Nebraska, New Jersey, North Dakota, Ohio, Pennsylvania, South Dakota, Tennessee, Virginia, and Wisconsin.

This is one of the most common misconceptions about reciprocity. Too often, adjusters believe or hear from someone else that some states enjoy more reciprocity than others (e.g. Texas is reciprocal with 32 states!). That may have been true once upon a time, but in today’s industry, reciprocity is predicated not on what state license you have but on whether it’s your home state license. So if you want to enjoy reciprocal licensing privileges, you need to hold your home state license first. It’s that simple.

Just because your home state is reciprocal with another does not mean you can just hop across state lines and begin working claims. You need to apply for the reciprocal license and pay the state’s fees. Obtaining reciprocal licenses will cost you anywhere from $55 – $175 per state for the application fees, plus the time it takes to complete all the necessary paperwork; usually about a day or two. Most states’ applications can be completed and submitted online from either NIPR or Sircon.

Select your state from the above list for state-specific reciprocal licensing rules, regulations, and tips.

View Reciprocity